All Categories

Featured

Think About Utilizing the DIME formula: cent represents Financial obligation, Income, Home Loan, and Education and learning. Complete your financial obligations, mortgage, and university costs, plus your income for the variety of years your household needs defense (e.g., till the children run out your home), and that's your protection requirement. Some economic experts determine the quantity you require utilizing the Human Life Worth viewpoint, which is your lifetime income potential what you're gaining currently, and what you anticipate to earn in the future.

One means to do that is to try to find business with solid Economic toughness rankings. houston term life insurance. 8A company that finances its very own plans: Some firms can sell plans from an additional insurance company, and this can add an additional layer if you intend to change your policy or in the future when your household requires a payment

How Long, Typically, Is The Grace Period On A $500,000 Level Term Life Insurance Policy?

Some companies provide this on a year-to-year basis and while you can anticipate your prices to rise considerably, it may be worth it for your survivors. Another way to compare insurance provider is by considering on the internet client reviews. While these aren't likely to inform you a lot about a company's financial security, it can tell you just how very easy they are to work with, and whether cases servicing is a trouble.

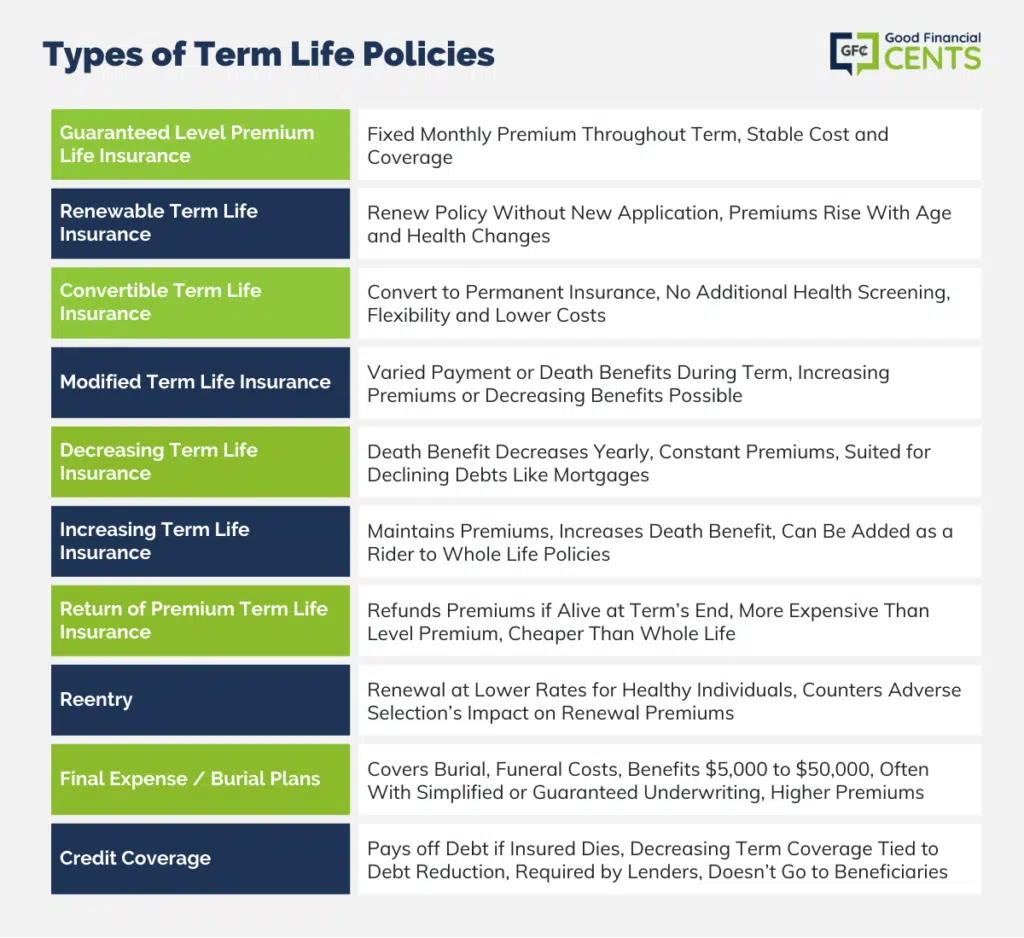

When you're younger, term life insurance coverage can be a simple means to shield your enjoyed ones. As life adjustments your monetary priorities can also, so you might desire to have entire life insurance coverage for its life time protection and additional advantages that you can use while you're living. That's where a term conversion is available in - which of the following is not a characteristic of term life insurance.

Authorization is ensured despite your wellness. The costs will not boost when they're established, however they will certainly rise with age, so it's a good idea to secure them in early. Locate out even more regarding exactly how a term conversion works.

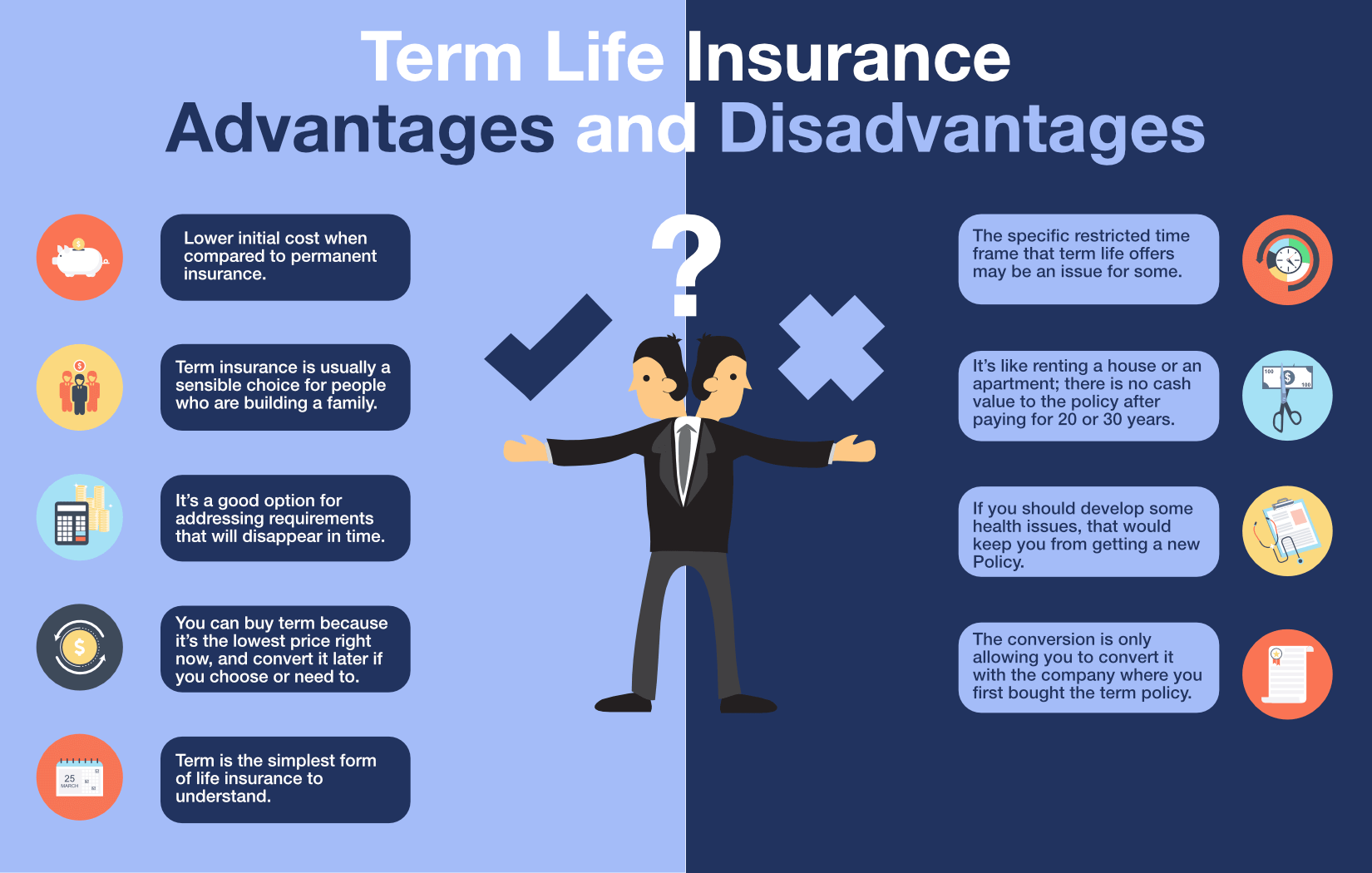

1Term life insurance policy supplies temporary security for a critical duration of time and is generally more economical than long-term life insurance. a term life insurance policy matures upon endowment of the contract. 2Term conversion standards and limitations, such as timing, may apply; for example, there may be a ten-year conversion privilege for some items and a five-year conversion opportunity for others

3Rider Insured's Paid-Up Insurance Acquisition Choice in New York. There is an expense to exercise this cyclist. Not all taking part policy proprietors are eligible for dividends.

Latest Posts

Term Life Insurance Cancer

Insurance For Burial Costs

New State Regulated Life Insurance Program To Pay Final Expenses